Land Investing for Passive Income: The Complete Wealth-Building Blueprint

Introduction to Land Investing for Passive Income

If you're tired of the volatility of stocks, the headaches of rental tenants, or the constant grind of managing properties, land investing may be your ticket to true passive income. Land doesn't break, depreciate, or require maintenance. It just quietly exists—appreciating in value, generating lease income, and protecting your wealth from inflation. Unlike traditional real estate, land is finite, with no new supply being created, making it a timeless store of value. As renewable energy and remote work reshape the economy, opportunities for land investors are greater than ever. Land stands out as one of the best investments for those seeking passive income opportunities, offering a reliable way to build wealth with minimal ongoing effort.

Why Land Is a Powerful Wealth-Building Vehicle

The Simplicity of a No-Tenant, No-Toilets Investment

Land is one of the easiest investments to manage. There are no roofs to fix, no tenants to chase for rent, and no maintenance emergencies. This hands-off approach allows investors to enjoy steady passive income without the typical hassles of direct property ownership.

Long-Term Appreciation and Inflation Protection

As populations grow and cities expand, land values steadily rise. However, economic conditions and economic downturns, such as the 2008 financial crisis, can significantly impact land values and market demand, sometimes leading to decreased demand and falling prices. Even in market slowdowns, raw land often retains its value better than built properties.

Tangible, Finite Asset with No Depreciation

Unlike buildings, land doesn't wear out. It's a real, physical asset that doesn't depend on structures or improvements to hold its value. This permanence makes land a reliable foundation for long-term wealth accumulation.

Lower Risk Compared to Other Real Estate Types

Landowners don't face evictions, damage repairs, or tenant turnover—just the quiet patience of holding a timeless asset. This stability reduces the stress and unpredictability often associated with other real estate investments.

Different Ways to Make Passive Income from Land

Leasing to Farmers and Ranchers

Agricultural leases can provide consistent annual income. Many farmers prefer leasing to buying, especially when expanding operations, as it allows them flexibility without the burden of large capital expenditures.

Natural Resource Leases

Timber, oil, mineral, and water rights can be monetized for long-term royalties. These leases often generate steady cash flow while the landowner retains ownership of the underlying property.

Renewable Energy Projects

Solar and wind developers seek large, open parcels for 20–30-year leases, often paying thousands per acre. This trend is accelerating as the demand for clean energy grows and governments offer incentives for renewable infrastructure.

Billboards and Cell Towers

Strategically located parcels along highways or urban areas can earn hundreds to thousands monthly from leasing land for cellular towers or signage, making them lucrative options for landowners seeking passive income from telecom leases.

Recreational and Event Leases

Rural land offers unique opportunities for passive income through recreational and event leases. You can lease your property for camping, hunting seasons, music festivals, outdoor retreats, and other special events. These uses attract a wide range of customers seeking natural settings for leisure and entertainment. With proper management and marketing, recreational leases can generate steady income while preserving the land's natural beauty and long-term value.

Buy-and-Hold Appreciation

Even if you choose not to lease or develop your land, simply holding well-located property can lead to significant appreciation over time. Land in growing or strategically important areas tends to increase in value due to factors like population growth, infrastructure development, and rising demand. While appreciation rates and investment outcomes can vary widely depending on location, market conditions, and economic cycles, a patient buy-and-hold strategy can build substantial wealth with minimal effort.

How to Choose the Right Type of Land for Your Strategy

Your investment goals determine your property type as well as your land type. For steady rent, choose farmland or grazing land. If you are aiming for appreciation, focus on suburban growth areas. For flexibility, look for mixed-zoning parcels. And if cash flow is your priority, target energy, billboard, or storage opportunities. To become and expert on investing in land, see The Ultimate Guide to Land Investment: How to Build Wealth with Raw Land.

Key Factors to Consider Before Buying Land

Location: Proximity to highways, cities, or power lines adds huge value.

Zoning: Always confirm future land-use potential before buying.

Access: Ensure legal access via roads or easements.

Utilities: Power, water, and internet availability can make or break deals.

Soil and Topography: Especially important for agricultural or renewable leases.

Before making a purchase, it's crucial to analyze local market conditions, as these can significantly impact rental income potential and overall investment profitability.

How to Perform Due Diligence Like a Professional

Before buying, conduct thorough research to avoid land traps:

Perform a title search for ownership or liens.

Order a boundary survey to confirm acreage.

Check environmental reports for flood zones or contamination.

Review easements and access rights carefully.

Calculate ROI based on taxes, potential lease value, and appreciation.

Financing Your Land Investment

Financing land investments can differ significantly from traditional real estate purchases, often requiring a more strategic approach. Unlike homes or commercial buildings, vacant land typically lacks immediate income potential, which can make lenders view it as a higher risk. As a result, land loans may come with higher interest rates, larger down payment requirements, and shorter repayment terms. Investors should explore various financing options, including conventional land loans, seller financing, and leveraging a brokerage account to access real estate investment trusts (REITs) or exchange traded funds (ETFs) that focus on land assets. Additionally, securing pre-approval and working with lenders experienced in land investing can streamline the process. Understanding the potential tax benefits and aligning financing choices with your investment goals and risk tolerance will help maximize returns while maintaining a healthy cash flow. For tips on how to finance your real estate investments with little money upfront, see Creative Financing for Real Estate Investors: Top Tips to Save Money.

Creative Strategies for Passive Land Income

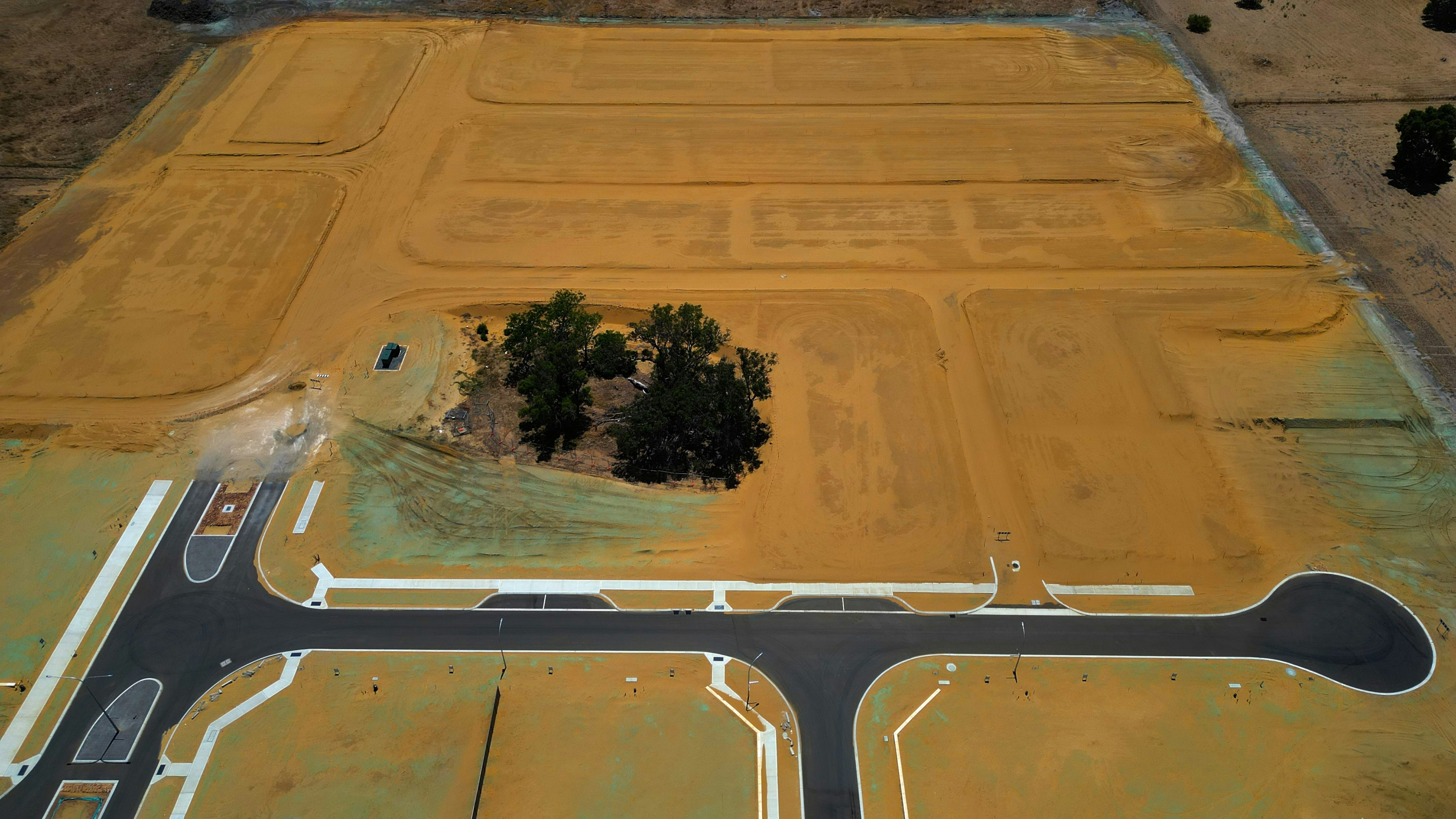

Subdividing and Reselling

Breaking a large parcel into smaller lots can multiply profits dramatically by appealing to a wider range of buyers. This strategy often requires some upfront investment in surveying and infrastructure but can significantly increase the total sale value compared to selling the land as a single piece.

Tiny Homes and RV Parks

The tiny living movement is booming, creating demand for affordable, flexible housing options. Landowners can capitalize by leasing individual pads or lots to tiny home owners and RV enthusiasts, generating steady monthly income with relatively low maintenance requirements.

Storage and Parking Income

Unused lots near cities or commercial hubs can be leased for vehicle or equipment storage, offering a practical solution for businesses and individuals needing extra space. This income stream requires minimal oversight and can provide consistent cash flow with little effort.

Eco-Tourism and Glamping

Nature-based hospitality is one of the fastest-growing travel sectors, with travelers seeking unique outdoor experiences. Landowners can develop eco-friendly camping sites or luxury glamping accommodations, attracting tourists and generating recurring income while promoting sustainable land use.

Carbon Credits and Conservation Leases

Earn money while preserving land through government-backed environmental programs that pay for carbon sequestration or conservation efforts. These leases provide a way to generate income passively while contributing to ecological sustainability and meeting increasing corporate demand for carbon offsets.

Tax Advantages of Land Ownership

Landowners enjoy incredible tax perks:

1031 Exchanges: Defer capital gains by reinvesting profits.

Deductions: Property taxes, interest, and improvements are often deductible.

Depreciation: Improvements like fencing or irrigation can be depreciated.

Capital Gains: Holding land long-term qualifies for lower tax rates.

If you invest through real estate funds or REITs, keep in mind that management fees are ongoing expenses that can impact your overall investment returns.

Cash Flow Management for Land Investors

Effective cash flow management is essential for successful land investing, requiring investors to carefully track all income sources—such as leasing land to farmers, utility companies, or rental properties—and account for recurring expenses like property taxes, insurance, and maintenance. Developing a detailed budget that forecasts expected income against anticipated expenses helps ensure sufficient cash is available to meet obligations. Utilizing tools like spreadsheets or accounting software facilitates monitoring cash flow, spotting trends, and making informed decisions. For example, leasing land to utility companies for solar panels can provide a steady stream of passive income to offset property taxes, while rental properties can generate consistent cash flow when managed well. By staying proactive with cash flow management, land investors can minimize financial risks, avoid cash shortages, and maximize returns on their investments.

Investment Portfolio Management with Land Assets

Building a resilient investment portfolio with land assets is key to long-term wealth and steady income. Savvy land investors understand that diversification across various property types—such as rental properties, real estate investment trusts (REITs), and direct property ownership—helps reduce overall risk while enhancing income potential. A well-balanced portfolio might combine short-term and long-term rental properties for regular earnings with REITs to gain exposure to larger real estate markets without the need for direct management. Direct ownership offers greater control and the potential for significant returns as property values appreciate over time. Regularly reviewing and adjusting your portfolio to align with your risk tolerance and investment goals is essential; for example, increasing holdings in rental properties or publicly traded REITs and exploring new properties in high-growth areas can maximize returns and steady income. By diversifying across various real estate investments, investors protect themselves from market fluctuations and position their portfolios for long-term success.

Market Volatility and Land Investment Resilience

Market volatility affects all investors, but land investments offer unique resilience when managed wisely. Unlike the stock market's dramatic swings, land and real estate tend to provide more stability, especially in high-demand or essential sectors. Diversifying across property types—agricultural, commercial, residential—and including real estate investment trusts (REITs) and mutual funds can help smooth returns by pooling resources across markets. Staying updated on market trends and balancing direct ownership with other investments like mutual funds enables land investors to achieve steady passive income while minimizing exposure to market fluctuations.

Working with Professionals in Land Investing

Partnering with experienced professionals such as real estate agents, attorneys, and property managers can greatly enhance your land investing success by helping you navigate local regulations, manage tax implications, and stay informed on market trends. Property managers handle daily tasks like rent collection and maintenance, freeing you to focus on growing your investment portfolio and generating passive income. Attorneys assist with due diligence, title insurance, and legal compliance, while real estate agents identify promising properties and negotiate deals. Building a trusted network of experts ensures informed decisions, minimizes risks, and maximizes returns, positioning your investments for long-term success.

Common Mistakes to Avoid When Investing in Land

Buying land without legal access or road frontage.

Ignoring environmental or zoning restrictions.

Overpaying based on speculation instead of data.

Holding land without monetization plans or management systems.

Relying solely on short term rentals for income without considering the stability and consistent cash flow provided by long term tenants.

Using Technology to Streamline Land Investing

Tech has revolutionized how investors buy, analyze, and manage land. They use tools like Google Earth and GIS for research, browse verified listings on platforms such as Land.com and LoopNet, employ AI valuation tools to estimate potential returns, and automate lease payments with digital property management software.

Building a Sustainable Long-Term Passive Income Portfolio

Successful investors don't buy just one property—they build scalable portfolios. Passive real estate investing focuses on creating recurring and steady passive income over time, allowing investors to generate reliable earnings with minimal active involvement. Diversifying across different types of land and various states helps spread risk and enhances long-term income potential. Utilizing digital tools to automate billing and tenant communication streamlines management, while reinvesting profits into higher-yield properties can accelerate portfolio growth. Partnering with experts in surveying, property management, and law further supports effective portfolio expansion and risk mitigation.

The Future of Land Investing

Land is becoming the new gold for patient investors, driven by several key trends. The expansion of renewable energy and infrastructure projects is increasing demand for land, while the migration of remote workers to rural areas is reshaping market dynamics. Additionally, rising global food demand is boosting farmland leasing opportunities, and institutional investors, including hedge funds, are acquiring massive land portfolios to achieve stability and long-term growth.

Conclusion

Land investing for passive income is more than just a wealth strategy—it's a long-term legacy. With minimal management, predictable appreciation, and diverse income opportunities, it's one of the most powerful ways to build sustainable financial freedom. Whether you're leasing farmland, hosting solar panels, or holding for future development, land is the quiet asset that keeps paying you back—year after year. This timeless investment offers stability and growth potential that few other assets can match, making it an essential component of a diversified portfolio focused on earning passive income.